It is a heady time for the gold bugs out there. Go back to the old days, before things got weird—say January of 2015. The price of gold per ounce was around $1,180. Fast-forward to January 1st, 2024: the price had risen to $2,062. Yesterday, four months and a few days onward, the price per ounce moved beyond $2,295. The price of gold, in other words, has increased at an incredible and fast rate, breaking out over the estimates offered by many forecasters working on behalf of big, gold cartel-aligned banks.

On X, Jehu—one of the ones fighting the good fight (insisting that money has a different function under the regime of fiat than it did under a gold standard)—suggests that the rising price of gold is a harbinger of some kind of impending crisis. “…the inverse of the rising price of gold is the devaluation of the dollar”, he tweets (posts?). “If this devaluation continues, sooner or later it will be expressed in a new burst of unemployment or inflationary price rises—likely both. In this sense, gold acts like the canary in the coal mine”.

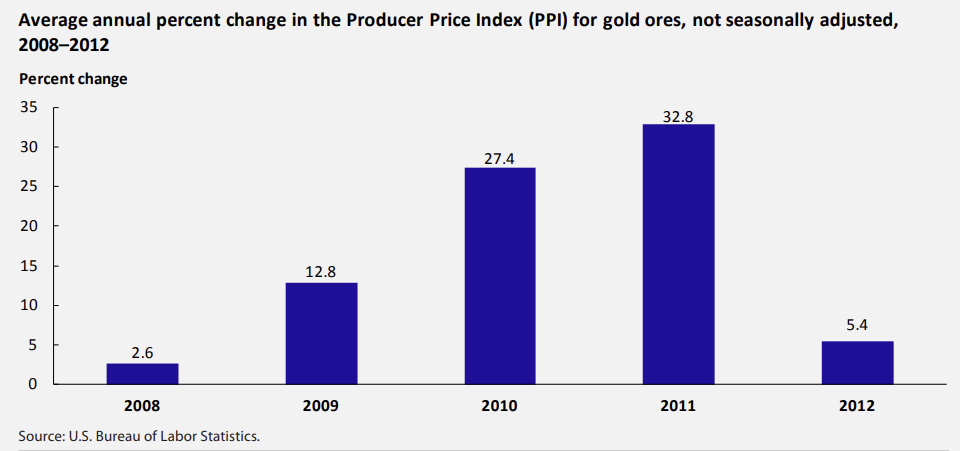

There is indeed a positive correlation between financial turmoil and increases in the price of gold, a basic truism that is even admitted by the Bureau of Labor Statistics. They offer this nifty chart:

Canary in the coal mine for sure—but there’s also something about gold that carries with it the unrelenting force of unanswerable mystery. Maybe it derives from the ancient religious function of gold and its role in temple economics—the catapulting of this material substance’s metallic sheen to the high level of divine radiance. Or maybe its the intrinsically obscure nature of the modern gold trade, which plugs the far, disparate (and desperate) corners of the globe, the towers and plush offices of Wall Street and the City of London, and the world of gangsters and secret agents together in the most direct sorts of ways. These things always go together, of course, but the thinness of the line demarcating the ‘legitimate’ gold trade from its black market shadow functions at a degree that you do not see in many other markets.

The borders of the mining camps deep in the heart of Africa’s gold country are patrolled by private armies decked out in high tech armaments and designer drugs thanks to the deep pockets of their investors (the literal descendants of the captains of the British India Company). A cabal of banking interests greet one another each morning to monitor and adjust the gold prices in their bullion market. How can such a tapestry not lead to an escalating regime of questions?

Do certificates representing gold holdings in underground Swiss vaults really function as a currency for intelligence operatives and special forces soldiers? Did Robert Maxwell loot his employee’s pension funds to bankroll the theft of the Soviet central bank’s gold reserves? What was the deal, exactly, with Peter Munk and Barrick, and what exactly was George H.W. Bush doing there?

Gold is intrinsically paranoia-inducing. The mere suggestion of it is also an intoxicant for all manner of kooky, hair-brained schemes. One of my personal favorite examples of this was when a slimy, penny-stock outfit called Las Vegas Entertainment Network was making a move to a slot machine operator called Jackpot Enterprises (itself a quite slimy outfit—one of the principles was Allen Tessler, who featured heavily in my PROMIS Land post) with financial backing of ‘Dr.’ Fred Cruz and his weirdo company, Countryland Wellness Resorts. Ostensibly a developer of new agey health-and-wellness retreats, Cruz reported to investors that Countryland had some $2 billion+ in gold mining assets. By the time it was supposed to be ponying up for the Jackpot play, Cruz and his cronies were telling the story that they had sold their gold mines and reserves to the Dominion of Melchizedek—an “eccelestical” country first conceived by a serial fraudster traveling under the name ‘Branch Vinedresser’.

Of course, the Dominion of Melchizedek wasn’t real, and neither was Dr. Cruz’s El Dorado (or was it?). The whole thing was something of a complex con conducted by the mob as it updated itself for the age of fitness gurus, internet sects and the Dotcom bubble. However truly weird this whole scene was, it didn’t stop Paul Pelosi Jr. (Nancy Pelosi’s son) from linking up with one of the Las Vegas Entertainment Network guys to in 2009 to launch Natural Blue Resources, an environmentally-conscious investment company. High Pynchonian Strangeness.

Where there is gold (real or fictitious or something in between), conspiracy follows, and when conspiracy leaves its spectral traces in the patterns of social life, conspiracy theory forms. Since gold is apparently the elixir of suspicion, it makes perfect sense that gold buggery and infectious enthusiasm for conspiracy theory smoothly walk hand-in-hand with one another. There is no pairing out there more natural that scanning the skies for signs of of United Nation aerial assault teams and stockpiling gold bars for when shit hits the fan, the last remaining means of exchange for normal folks when hyperinflation soars, the radiation bombs fly and we’re brought face-to-face, at long last, with TEOTAWKI.

Maybe the absolute commodification of the prepper’s gold-mindedness—we all have a boomer in our life telling us to buy gold—was something of a direct forerunner to the absolute commodification (and psy-opish redeployment) of conspiracy theory. Who knows. No matter how much junk and kipple piles up around them, I remain sympathetic to the conspiracy theorist, the prepper, the UN-fearing nut, and the gold bug.

If you spend any amount of time digging through the infinite pile of gold conspiracy theorists and econo-doomers that courses through the cybernetics veins of the ‘web, you will quickly stumble across GATA—the Gold Anti-Trust Action Committee. Dismissed as quacks by the economic mainstream, GATA from time to time gets a grudging acknowledgement from the likes of FT and forecasters working for the big banks, but more often than not they’re placed in the same category as, say, Zerohedge.

Right up front, I have to say: I really like GATA. Sure, they present a historical metanarrative around gold that I do not really agree with—they interpret world historical event like the collapse of the London Gold Pool and the subsequent delinking of the dollar and gold to the whims of insidious actors, instead of viewing it as the expression of capital’s terminal crisis—but they raise a number of quite troubling points about the world system that should be considered. Plus, they are deeply considered with the activities of the Federal Reserve and other central banks and their collusion with private banks, so they’re already speaking the same language as we explorers of the Metacartel.

The basic thrust of GATA’s analysis is that there is a gold cartel, the discovery of which unfolded in several key steps. Here’s how they described their own development in a 2010 letter to the chairman of U.S. Commodity Futures Trading Commission:

Initially we thought that the manipulation of the gold market was undertaken as a coordinated profit scheme by certain bullion banks, like JPMorgan, Chase Bank, and Goldman Sachs, and that it violated federal and state anti-trust laws. But we soon discerned that the bullion banks were working closely with the U.S. Treasury Department and Federal Reserve in a gold cartel, part of a broad scheme of manipulation of the currency, precious metals, and bond markets.

As an executive at Goldman Sachs in London, Robert Rubin developed an idea to borrow gold from central banks at minimal interest rates (around 1 percent), sell the bullion for cash, and use the cash to fund Goldman Sachs’ operations. Rubin was confident that central banks would control the gold price with ever-more leasing or outright sales of their gold reserves and that consequently the borrowed gold could be bought back without difficulty. This was the beginning of the gold carry trade.

When Rubin became U.S. treasury secretary, he made it government policy to surreptitiously operate an identical gold carry trade but on a much larger scale. This became the principal mechanism of what was called the “strong-dollar policy.” Subsequent treasury secretaries have repeated a commitment to a “strong dollar,” suggesting that they were continuing to feed official gold into the market more or less clandestinely to support the dollar and suppress interest rates and precious metals prices.

Another plank in GATA’s analysis is a paper that published in 1985 titled “Gibson’s Paradox and the Gold Standard”, written by economist Robert Barsky and that freak of the highest order, Larry Summers (Robert Rubin’s successor as Treasury Secretary when Rubin left government to cruise over to join Citigroup, which was able to form due to the former Treasury chief’s assault on Glass-Steagal). The titular ‘Gibson’s Paradox’ is the observation, first made by Alfred Herbert Gibson but elaborated upon by Keynes, that under a gold standard there was a positive correlation between nominal interest rates and price levels. Barsky and Summers sought to provide an adequate explanation for the paradox, ultimately finding that movements in gold price (fixed or otherwise) exerted a determining force upon interest rates.

The GATA fellows have unearthed statements made by Alan Greenspan—chairman of the Federal Reserve for the long period of 1987 through 2006—before the Federal Open Market Committee that shows how he was operating under the influence of Barsky and Summer’s research. This implication of this line of thought is that “Gibson’s Paradox and the Gold Standard” gave articulation to a broad-spectrum approach to manipulating interest rates and bond prices through the covert manipulation of the gold price—the theoretical counterpart to the more practical and pragmatic gold carry trade techniques cultivated by Rubin back in his Goldman Sachs days.

This convergence between gold deals between private banks and companies on one side and the central bank on the other with this wider price-manipulation/cartel economics scheme can be glimpsed in the lawsuit filed by Blanchard & Co., a precious metals retailer/rare coin dealer, against the ever-sinister Barrick Gold Corp. An opinion arising from the suit gives a good overview:

Plaintiffs' antitrust claim is generally that the defendants unlawfully combined and conspired to actively artificially manipulate the price of gold, monopolize the market in gold and cause antitrust injury… More particularly, plaintiffs allege that Barrick's "Premium Gold Sales Program," unlike ordinary hedging programs, is a purposeful and unlawful mechanism to manipulate the price of gold both upwards and downwards. The mechanics of such program entails (1) JP Morgan and other bullion banks, acting on Barrick's behalf and at Barrick's direction, borrow contractually specified amounts of gold from a central bank and physically sell the gold into the spot market: (2) money from the spot market is then invested by JP Morgan; (3) JP Morgan pays the central bank a gold lease rate (a percentage lower than that earned by capital generated from the spot sale, with the interest premium being profit for Barrick); (4) at some future date, Barrick delivers gold to JP Morgan; and (5) JP Morgan returns the gold to the central bank.

Barrick, for its part, attempted to have Blanchard’s suit dismissed, and in a legal memorandum issued to support the dismissal, the mining giant made some statements that GATA fellow-travelers have taken as something a smoking gun. “Numerous entities around the world act as bullion banks”, wrote the Barrick lawyers, “which borrow gold from central banks and purchase gold from producers pursuant to future contracts”. They then added that “Most world’s leading gold mining companies hedge some portion of their anticipated production”, before listing a number of “producers that reportedly engage in forward sales, ‘spot deferred’ contracts, or other hedging transactions”. They included Barrick in the list.

The inclusion of Barrick—which once included arms dealer Adnan Khashoggi as a major shareholder, who may have used some of his stock in the company as collateral for loans to underwrite Iran-Contra weapon transactions—in this nexus brings this whole situation into alignment with yet another theory of a gold cartel, this time one offered by the good folks at Executive Intelligence Review. In the mid-1980s, EIR was writing articles that tied Consolidated Gold Fields, a British-controlled South African mining giant, to a worldwide cartelization of gold. Soon enough, De Beers, itself the dominant player in the diamond cartel, was buying up huge chunks of Consolidated Goldfields stock—all the while operating in conjunction with its primary partner in Africa, the fearsome juggernaut of the Anglo American Corporation (now Anglo American Plc).

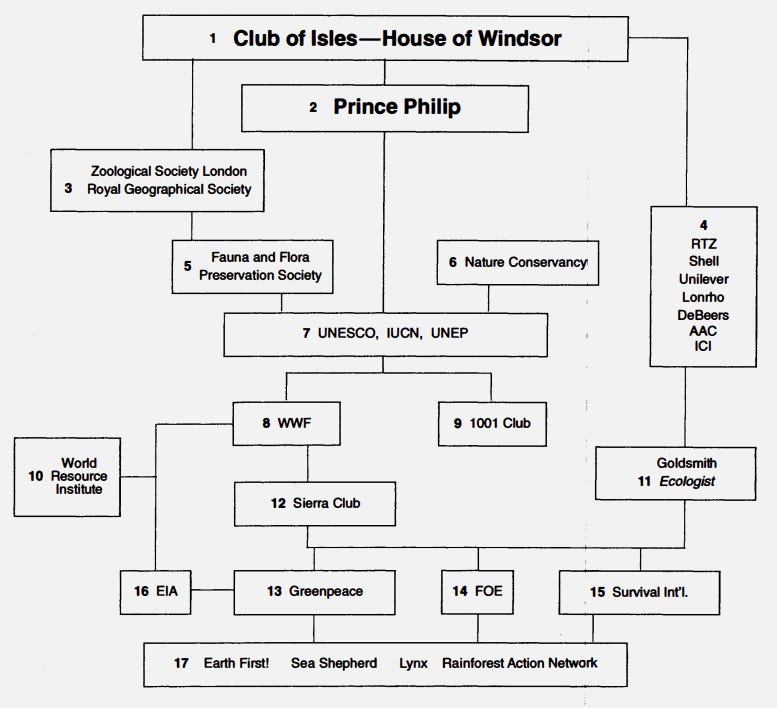

Anglo American’s cartelizing tendencies expand far beyond gold; it dominates all manner of precious metals and other natural resources, frequently extending its grasp through the strategic usage of corporate stalking horses and astoundingly complex organizational chains to obscure ownership structures.

According to Jeffrey Steinberg, the economic base of support for the House of Windsor is an informal grouping called the Club of the Isles, “which combines the political and financial clout of a far more extensive combine of intermarried European royal and princely families that extends from Scandinavia to Greece”. “The estimated combined financial worth of the Club of the Isles”, he continues, “is greater than $1 trillion and the holdings in which the club has controlling interest are believed to exceed $9 trillion. The world petroleum supply is dominated by the British royal household, as is much of the world's supply of precious metals and raw materials, through such ‘Crown jewels’ as Rio Tinto Zinc, Lonrho, and DeBeers Anglo American Corp”.

Sounds crazy? Consider the following (and this is just one set of facts among many): the meandering career of Peter Munk, the erstwhile driving force behind Barrick, was facilitated in part through the intercession of Henry Keswick, a former British intelligence officer whose family has maintained a dynastic control-grip on Jardine Matheson—the star of Britain’s imperial influence in Hong Kong. The illustrious Keswick family has not been content to stay within the hallowed halls of Jardine. They have also populated the board rooms and executive suites of numerous precious metals companies ranging from Rio Tinto to Consolidated Gold Fields to Anglo American.

Or simply take the numerous instances where Barrick, ostensibly a Canadian company, has joined forces with entities like Anglo American to gobble up smaller mining companies—not to mention the fact Anglo American-owned companies are named alongside Barrick in the list of gold producers participating in gold hedging transactions with central banks. What looks like first like a ramshackle, corkboard-and-string map actually reflects both the dynamics of class power and a generalized transformation in the processes of production and distribution themselves. Don’t forget what Lenin said about interlocks in Imperialism:

Ownership of shares, the relations between owners of private property “interlock in a haphazard way”. But underlying this interlocking, its very base, are the changing social relations of production. When a big enterprise assumes gigantic proportions, and, on the basis of an exact computation of mass data, organises according to plan the supply of primary raw materials to the extent of two-thirds, or three-fourths, of all that is necessary for tens of millions of people; when the raw materials are transported in a systematic and organised manner to the most suitable places of production, sometimes situated hundreds or thousands of miles from each other; when a single centre directs all the consecutive stages of processing the material right up to the manufacture of numerous varieties of finished articles; when these products are distributed according to a single plan among tens and hundreds of millions of consumers (the marketing of oil in America and Germany by the American oil trust)—then it becomes evident that we have socialisation of production, and not mere “interlocking”, that private economic and private property relations constitute a shell which no longer fits its contents, a shell which must inevitably decay if its removal is artificially delayed, a shell which may remain in a state of decay for a fairly long period (if, at the worst, the cure of the opportunist abscess is protracted), but which will inevitably be removed.

But to return to the world of GATA…

One bit of evidence of all this secret gold business that I’ve found particularly haunting is the possibility that the Treasury, via its Exchange Stabilization Fund (ESF), has engaged in clandestine gold swaps. The ESF is a special mechanism for economic interventions—particularly foreign exchange rates—that it can conduct without having to tamper with the overall money supply. The general line is that the ESF has no gold, having sold its remaining stores of the metal following the 1971 Nixon Shock. Today it handles a basket of several different currencies, and holds many billions of IMF special drawing rights (if you’re unfamiliar with SDRs, you can read this September, 1970 CIA intelligence memorandum analyzing SDRs as a means of expanding international liquidity beyond the limits of gold).

In 1994, Mexico was rocked by an economic crisis. Often dubbed the ‘peso crisis’, these events largely resulted from the policies promoted by the George H.W. Bush and Clinton administrations. First, there was the Brady Plan (named for Bush Treasury chief Nicholas Brady) for developing world debt relief—dollarization of the economy, removal of trade barriers, all that good stuff, and then there was the approval of NAFTA, which accelerated the in-flows of foreign financial capital that the Brady Plan had led the way for. And so by the end of ‘94, capital flight was underway, speculators were lined up against the peso, the currency was devalued, and the dollars were becoming scarce.

It was in this context that the ESF leapt into action. Clinton had tried to advance a program for Mexican ‘economic stabilization’ through Congress, who had blocked the scheme—but ESF functions are not determined by the legislative branch. This loophole allowed the Treasury to set up a multibillion dollar swap line with Mexico, through which it could pump dollars into the country and arrange loan guarantees.

During the January 31st-February 1st, 1995 meeting of the Federal Reserve’s Federal Open Market Committee (chaired by Alan Greenspan), the legality of the ESF operations was questioned. Defending them was the Federal Reserve’s chief counsel, Virgil Mattingly, who offered a concise statement on the full powers of the ESF:

MR. TRUMAN. I can only say that Treasury lawyers have looked into the question of whether these operations are legal under this broad authorization of what they can do and what the purpose is--

MR. MATTINGLY. If I can help out?

MR. LINDSEY. Yes.

MR. MATTINGLY. It's pretty clear that these ESF operations are authorized. I don't think there is a legal problem in terms of the authority. The statute is very broadly worded in terms of words like "credit"—it has covered things like the gold swaps—and it confers broad authority. Counsel at the White House called the Treasury's General Counsel today and asked "Are you sure?" And the Treasury's General Counsel said "I am sure." Everyone is satisfied that a legal issue is not involved, if that helps.

In summer of 2001 this issue became something of a small political hullabaloo, which led Alan Greenspan to ‘request information’ from Mattingly concerning the 1995 statements about ESF gold swaps (this was an interesting maneuver, given that Greenspan himself had chaired that meeting). Mattingly responded to Greenspan with a disavowal: “Given the passage of time, some six years later, I have no clear recollection of exactly what I said that day but I can confirm that I have no knowledge of any ‘gold swaps’ by either the Federal Reserve or the ESF… With respect to the activities of the ESF, I note that the Treasury Department stated in a recent court filing that the ESF has not held any gold since 1978”.

Greenspan dispatched a copy of this letter to a senator who had been inquiring about the gold swaps. Mattingly eventually went to work for Sullivan & Cromwell, a white shoe firm in need of no introduction for CIAheads.

What might be the purpose of the ESF gold swaps be, and why did Greenspan and Mattingly work to obscure them? James Turk, a former Chase Manhattan banker and one-time manager of the Abu Dhabi Investment Authority’s Commodity Department, has suggested an answer. Turk noticed that in the same 1995 FOMC meeting where the gold swaps were mentioned, it was disclosed that besides the Mexican swap arrangements, the ESF also maintained a swap line with the Bundesbank in Germany. He was then alerted to an intriguing change that the Treasury had made in its account books in 2000. In August 2000, it had labeled the 1700 tonnes of gold held at the US mint in West Point as ‘gold bullion reserve’, but a month later it had been changed to ‘custodial gold’.

Turk’s hypothesis is that the gold at West Point had been utilized in a gold swap with Bundesbank. The West Point gold became gold held in custody by the Treasury on behalf of Bundesbank, and in the swap arrangement the gold held in Bundesbank became that of the Treasury. Part of his reasoning is that buried deep in the Consolidated Financial Statement of the US Government (CFS) published by the General Accounting Office (GAO) is the revelation that the Treasury was reporting a $20 billion liability in ‘international monetary assets’, a category of assets that includes gold. The 1700 tonnes, with gold then at $280 per ounce, is $15.3 billion dollars.

This is all very convoluted, and it still isn’t clear why this might have happened. There isn’t really a firm answer to this question, but a potential reason might be found in the function of a swap line itself: they are to provide currencies to foreign central banks, who then transform it into loans for member banks in their jurisdictions. It follows that the Bundesbank could have been providing gold to German bullion banks, perhaps in keeping with the funny dynamics of the gold carry trade. It might be important in the aforementioned Barrick ‘confession’ document, Barrick’s attorneys listed gave a list of bullion banks that were actively borrowing gold from their respective central banks. Included on the list was Commerzbank, Deutsche Bank, and Dresdner Bank—all major German banks. All three are counted among the top ‘market makers’ according to the London Bullion Market Association, sitting alongside Barclays, Citibank, Goldman Sachs, HSBC, J.P. Morgan, and Union Bank of Switzerland.

Does the recent explosion in the price of gold signal the unraveling of the gold cartel’s schemes—which is another way of asking: are the real limits of the central bank-Treasury complex being realized? I’m not sure if I would go that far. It seems quite plausible to me that there is some kind of economic crisis on the horizon, but at the same time the Metacartel has shown itself to be adept at suspending crisis in its most acute forms. This doesn’t mean that it guarantees growth—stagnationist trendlines are the mark that it imposes on the world—only that the freeze-out of capital’s crisis-motor is how the Metacartel realizes itself, reproduces itself.

In conclusion, here’s a final GATA quote, one that takes these problems to the geopolitical level and effectively cross-laces them with the emergence of multipolarity:

GIN: You have central banks that do report their purchases and sales. Given that gold is so important and western central banks do not have the metal that they once had, why are there no reports of western central banks buying gold when we see emerging nations central banks buying at an increasing pace?

CP: I think its because there are two central bank groups operating in the world, an eastern group and a western group. The western group is with the United States in suppressing the gold price to support the dollar. The eastern central banks are not part of that, and I think they see gold as a very good reserve asset long term. Not every central bank in the world is in on the gold price suppression scheme.

A few years ago, the Wikileaks included cables from the U.S. Embassy in Beijing to the State Department in Washington. These were translations into English of Chinese government news agencies reporting the western gold price suppression scheme. The significance of these cables is that they show that the Chinese government has long been aware of the western gold price suppression scheme - and the U.S. government knows that the Chinese government knows.

I have some treasury documents on the ESF, will send them in the discord one I get them sorted

Great article. Maybe this is something you're more knowledgeable on than I am, but I would think that if the "Gold Cartel's" schemes are being "unraveled" then it would imply that the gold price increases are against their interests. And I guess, if "Gibon's Paradox" is being treated as law, that they don't want the interest rates to decrease.

My unconscious assumption is that they're more ambivalent about interest rates due to the elastic nature of fiat currency.